Al Stock Screener: AI-Driven Market Scanner

AI Stock Screener is an AI-driven market scanner that analyses 20,000+ US & UK stocks, removes noise, and highlights the strongest setups

20,000+ US & UK Stocks

All in one Powerful Screener

See Our AI Stock Screener in Action

Helping to better understand Chart Pattern Chart Pattern

Why use Stock Screener with AI?

You Focus on Right Chart

Patterns on a chart tell you where price has been. Our AI Filter out the relevant ones that needed your attention

See the Move Before It Happens

Detect authentic strength and conviction behind price moves before traditional charts confirm the breakout

Tradeable Risk - Reward Setup

Every stock is scored for upside vs. downside - so you only focus on setups worth trading, not just pretty patterns

Simplify Market Research with an AI Stock Screener

With our AI Stock Screener, you get instant clarity on market strength that help you focus on stocks that show real momentum.

Backed by data-driven analysis, it helps you instantly identify strong setups, filter out false signals, and approach every trade with clarity and confidence. With this, you cut the time on endlessly scrolling through charts. Use an AI-powered stock screener that doesn’t just filter – it interprets patterns like technical breakouts, volume surges, and sector strength across thousands of stocks to highlight those showing real momentum before the crowd.

How are AI Stock Screener Works

No more endless charts or guesswork. Stocksscreener makes it easy to scan,

analyse, and rate stocks in minutes

Step 1.

Scan the Market

Our AI stock screener runs end-of-day analysis on 20,000+ stocks, evaluating which ones are primed to break out

Step 2.

Analyse your Picks

The system removes low-quality charts (thin liquidity, choppy noise, weak confirmation) and shortlists candidates showing real signs of accumulation

Step 3.

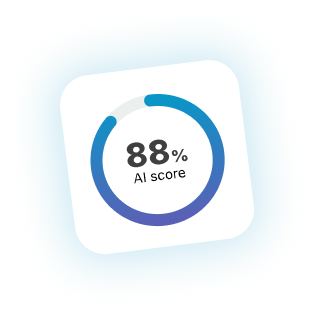

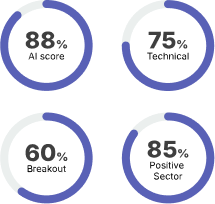

Run AI Score

Each candidate receives an AI Score that blends technical strength, volume confirmation, volatility profile, and risk/reward quality

Years in Tech

20+

As Retail Investor

10+

Biraj Borah

Founder - Aionstocks

“We’re democratising institutional-grade AI analysis, making sophisticated stock screening accessible to every investor.”

With over 20 years of experience in quantitative finance and technology innovation, Biraj founded Aionstocks to bridge the gap between complex financial data and actionable investment insights

Tech Entrepreneur

Bridging AI and Finance

Trader Innovation

Transforming Data into Decisions

Frequently Asked Questions

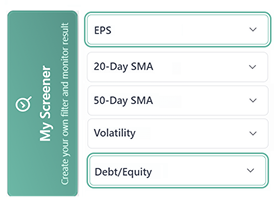

To find the best trading opportunities, the AI stock screener ranks stocks based on momentum, volume, volatility, and breakout strength. Instead of manually scanning charts, the AI instantly surfaces the top candidates helping traders focus only on stocks with real movement and clean setups.

Breakout traders typically screen for high relative volume, increasing momentum, tight consolidations, sector strength, and clean resistance levels. The AI stock screener automates this by scoring each stock against these criteria and presenting a ranked list of breakout-ready setups

An AI stock screener uses algorithms and machine learning to analyse both historical data and live market information. Instead of relying on rigid filters, Stocksscreener evaluates momentum, volume, volatility and sector strength to rank shares by their breakout potential. The more data it processes, the more accurate it becomes - continuously refining its signals to help traders identify opportunities that traditional screeners may overlook.

A stock screener with AI can significantly cut research time and keep you focused on higher-quality opportunities. Many traders are now saving hours of work and saving by avoiding trading on wrong charts

Traditional screeners works on historical performances. Stocksscreener goes further by using AI adapting to real-time market conditions. It specialises in spotting genuine breakouts versus false ones - something a chart alone cannot always reveal. You begin the day with a focused shortlist rather than endless charts

Both. Day traders benefit from a clear pre-market shortlist of high-momentum setups, while swing traders receive quality breakouts and pullbacks with favourable risk/reward profiles. Long-term investors can also use the tool to identify fundamentally strong shares supported by healthy technical patterns.

Yes. The AI screener acts as a powerful first filter - it narrows thousands of shares down to those “already tightening up and building momentum.” However, you should still confirm levels, triggers and risk management with your own strategy. Think of it as a way to bring the best opportunities to the top of your watchlist.

Stocksscreener currently covers UK and US equities, focusing on liquid names most suited to active trading.

The screener analyses end-of-day and pre-market data to generate actionable shortlists before the trading session begins. This gives you an edge when planning trades ahead of the open.

Yes. You can adjust lists and filters to fit your trading style, whilst still benefiting from the AI’s rankings. This flexibility means you can align the tool with your strategy without losing the advantages of AI-powered insights.

Yes. Beginners trader often struggle to interpret charts or filter out noise. An AI stock screener simplifies the process by selecting stocks that already meet strong technical conditions helping new traders avoid weak setups and improve decision-making

What Our Users Say

The AIonstocks beta made stock picking so much simpler. I loved how quickly I could scan for opportunities—can’t wait for the full launch!

Interactive Broker

As a beginner, I found the platform incredibly easy to use. It has definitely helped me better understand and manage my risk more thoughtfully

Stock Trader, Robinhood

I was impressed by how the AI highlighted potential breakout stocks. The insights helped me focus my research and saved me hours of work

Equity Trader, LSE

Ready for AI-driven stock analysis

Start your free trial and experience the power of Stocksscreener today.