Al Day Trading: From Smart Screener to AI powered indicators

Stocksscanner is next-generation AI day trading software designed specifically for US and UK stock traders. Whether you’re scanning NASDAQ tech stocks or FTSE 100 shares, our AI models cut through the noise and surface the few opportunities worth your attention

Discover How AI Enhances Day Trading

Helping to better understand Chart Pattern Chart Pattern

AI Scans 10,000+ Stocks to Find the Best Setups for Day Trading

You Focus on Right Chart

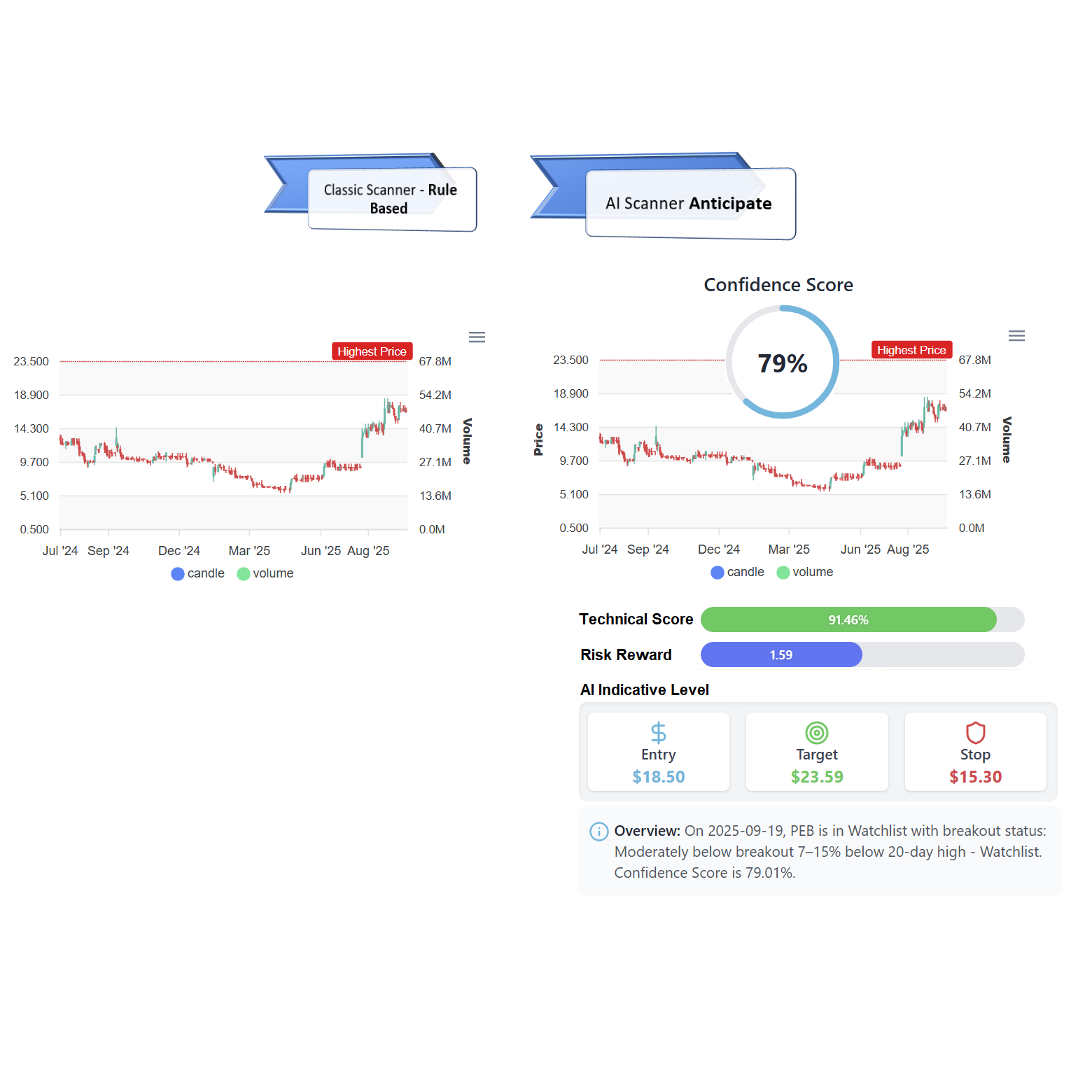

Patterns on a chart tell you where price has been. Our AI Filter out the relevant ones that needed your attention

See the Move Before It Happens

Detect authentic strength and conviction behind price moves before traditional charts confirm the breakout.

Tradeable Risk - Reward Setup

Every stock is scored for upside vs. downside - so you only focus on setups worth trading, not just pretty patterns

We Reveal Strength Beyond the Chart

For many active day traders, the challenge isn’t knowing how to trade. It’s filtering through endless charts to identify the few opportunities worth acting on. This is where AI for day trading makes a real difference.

Charts show price patterns -but they don’t reveal whether a move has the real power to last. Our AI Day Trading goes deeper by analysing momentum, sector strength, and risk-reward – factors that can’t be seen on a single chart. The result is a data-driven view of strength that highlights where institutional support is building and where breakouts are more likely to succeed.

Why Day Traders are now turning to AI

It takes the kind of complex, data-driven analysis used by professional trading desks and turns it into insights any trader can understand.

Each evening, the AI stock screener runs a comprehensive end-of-day scan across 10,000+ stocks, evaluating which ones may be quietly setting up for a move.

By filtering out noise – illiquid charts, erratic patterns, and false breakouts, it surfaces only the setups showing signs of accumulation and institutional interest.

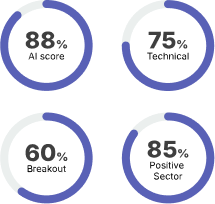

Every candidate is then given an AI Score, combining technical strength, volume confirmation, volatility, and risk-reward balance to help traders focus where it matters most

How to use AI for Day Trading

No more endless charts or guesswork. Stocksscreener makes it easy to scan,

analyse, and rate stocks in minutes

Step 1.

Scan the Market

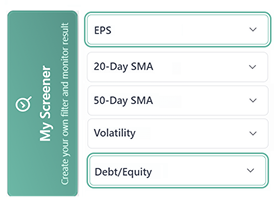

Run powerful screeners or apply fundamental filters to instantly narrow down thousands of stocks

Step 2.

Analyse your Picks

Dive deeper into the shortlisted stocks – spot setups that match your trading style

Step 3.

Run AI Score

Run AI score on technical strength, risk-reward, etc. to bring clarity

Years in Tech

20+

As Retail Investor

10+

Biraj Borah

Founder - Aionstocks

“We’re democratising institutional-grade AI analysis, making sophisticated stock screening accessible to every investor.”

With over 20 years of experience in quantitative finance and technology innovation, Biraj founded Aionstocks to bridge the gap between complex financial data and actionable investment insights

Tech Entrepreneur

Bridging AI and Finance

Trader Innovation

Transforming Data into Decisions

Frequently Asked Questions

The best way to find stocks for day trading is to scan for high-volume, high-volatility stocks showing strong momentum or clear breakout levels. AI stock scanners make this process faster by analysing thousands of stocks and highlighting those with favourable risk- reward, volume surges, or momentum trends. This helps day traders focus only on stocks with actionable setups.

Yes. AI stock scanners analyse thousands of stocks to detect momentum shifts, breakout patterns, and volume spikes in seconds. Instead of manually searching for setups, AI delivers a focused shortlist of high-probability intraday opportunities saving time and improving consistency

Both can work depending on your strategy. Large-cap stocks offer liquidity and tighter spreads, while small caps provide bigger intraday price swings. AI day trading scanners evaluate both, ranking stocks based on momentum, volatility, and breakout potential -not just market cap

AI Day Trading uses artificial intelligence to analyse market data and identify intraday trading opportunities. Instead of relying solely on charts, an AI day trading system scans thousands of data points to detect momentum, volume spikes, volatility shifts, and breakout setups helping traders react faster and with more confidence.

Common indicators day traders use include VWAP, relative volume (RVOL), RSI, MACD, moving averages, and support - resistance levels. AI day trading software incorporates these indicators along with deeper data analysis to identify stocks with strong intraday potential

Day traders typically look for stocks with strong liquidity, tight spreads, clean technical patterns, unusual volume, and strong momentum. Breakout levels, sector trends, and volatility also play a key role. Stocksscanner tools help traders identify these conditions instantly without manually scanning charts

AI day trading software applies algorithms and machine learning to process historical and end-of-day (EOD) market data. It scans over 10,000 US and UK stocks, evaluating momentum, volatility, sector strength, and risk reward. As the AI analyses more data, the signals continuously improve and highlights opportunities traditional stock screeners often miss out

Yes. AI for day trading reduces research time by filtering out weak setups and identifying higher-probability trades. By surfacing stocks with genuine breakout potential, AI helps day traders make quicker and more consistent decisions

Stocksscanner goes beyond basic price-and-volume filters. Its AI model adapts to market conditions, analysing sector trends, momentum strength, and market context to separate true breakouts from false moves. It also delivers pre-market shortlists so traders start the day prepared without having to scan endless charts manually

No. While built for intraday traders, swing traders and long-term investors also benefit. The AI highlights momentum shifts, pullbacks, and fundamentally strong stocks with supportive technical patterns, making it useful across multiple trading styles

Yes. The AI day trading screener acts as your first filter, narrowing thousands of stocks into a focused shortlist. You should still confirm entries, triggers, and risk management using charts and your trading plan. AI provides the ideas—execution remains in your control.

Currently, we covers US and UK equities, focusing on liquid stocks most suited to active trading strategies.

We generates shortlists from end-of-day and pre-market data, giving you a tactical advantage before the trading session begins. This approach helps you plan trades in advance, rather than chasing opportunities after the move is already underway.

Yes. You can customise filters, lists, and preferences while still benefiting from the AI’s scoring and ranking engine. This flexibility ensures the system adapts to your trading style without losing the power of its AI-driven analysis

Beginners often use stock scanners, stock screeners, or AI day trading tools to filter for liquid, volatile stocks showing strong intraday movement. These tools help simplify decision-making and eliminate weak setups that beginners might otherwise chase.

What Our Users Say

The AIonstocks beta made stock picking so much simpler. I loved how quickly I could scan for opportunities—can’t wait for the full launch!

Interactive Broker

As a beginner, I found the platform incredibly easy to use. It has definitely helped me better understand and manage my risk more thoughtfully

Stock Trader, Robinhood

I was impressed by how the AI highlighted potential breakout stocks. The insights helped me focus my research and saved me hours of work

Equity Trader, LSE

Ready for AI-driven stock analysis

Start your free trial and experience the power of Stocksscreener today.